What Is Sage Intacct ERP and How Can It Help Your Business?

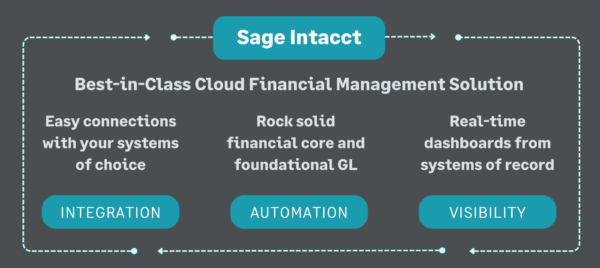

Sage Intacct is a modern, cloud-based financial management software solution that adapts to the pressing demands of today’s dynamic business environment. It goes beyond accounting software, offering a platform for businesses to harness their financial data to fuel strategic growth and streamline operations.

In an age where financial compliance, real-time reporting, business intelligence, and scalable software are the cornerstones of business success, solutions like Sage Intacct cloud accounting software have become indispensable tools for modern enterprises.

Is Sage Intacct Cloud Based?

Sage Intacct is a true cloud accounting software solution, hosted on a multi-tenant system accessed via a web browser. With multi-tenant, all clients share the same software application (while their data is isolated from other tenants). As a result, clients automatically get the latest upgrades to their financial management software. It also is highly configurable, allowing companies to use self-service tools to grow at their own pace. Moreover, true cloud-based solutions make it easy to connect to other applications like Salesforce. Lastly, companies save money on costs and benefit from the reliability of infrastructure they could likely never afford on their own.

Why Are Companies Moving to Cloud Accounting Software?

The business world is witnessing a paradigm shift in financial management, driven by digital transformation and an intensified focus on efficiency and compliance. In recent years, the adoption of cloud-based solutions has skyrocketed, with a report from Gartner predicting that by 2025, over 85% of enterprises will embrace a cloud-first principle. This trend is a response to a deeper need for agility and flexibility in business finances and operations — partially fueled by the increasing commonality of mergers, acquisitions, IPOs, and private equity infusions.

Recent high-profile financial scandals and tightening regulatory requirements globally underscore the importance of robust accounting controls. (Did you know that FTX, the billion-dollar failed crypto company, used QuickBooks?) Strong financial controls are not a luxury — such controls are critical for businesses to maintain credibility and avoid costly compliance issues. Sage Intacct, a cloud-based financial management system, addresses this need head-on by offering unparalleled control and compliance capabilities.

Cloud migration represents a strategic shift towards more resilient and adaptable financial operations. The COVID-19 pandemic, for instance, amplified the need for remote access and real-time financial data analysis. Businesses with cloud-based accounting applications and other systems could adapt more quickly and effectively, maintaining continuity in unprecedented circumstances. In fact, a survey by Deloitte revealed that companies with advanced cloud solutions reported a significant advantage in operational resilience and agility during the pandemic.

In addition, the evolving landscape marks a growing need for real-time financial and operational insights and data-driven decision-making. Traditional ERP and accounting systems, which often rely on periodic reporting, struggle to keep up with the pace of modern business. Sage Intacct’s real-time financial reporting capabilities empower businesses to make informed decisions swiftly, staying ahead in a fast-paced market. In short, Sage Intacct helps companies successfully navigate this new landscape.

What Are the Top 5 Key Features of Sage Intacct?

If you’re early in your search for a new cloud-based accounting application, we’ve pulled together five of our client’s favorite features of Sage Intacct to help you decide if it’s right for you.

1. Multi-Dimensional Reporting and Dashboards: Quick Access to Deep Knowledge

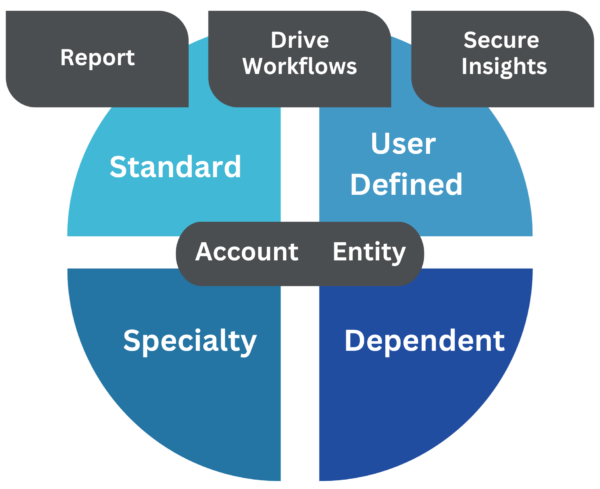

Dimensions simplify your chart of accounts and allow for comprehensive and customizable financial reporting and analysis. Using dimensions, you can “tag” transactions and operational data with dimension values (think department, location, employee, or project). Then, when you create reports, you can filter and group your financial and operational data by dimensions.

2. Multi-Entity Accounting

Sage Intacct is built to support growing businesses with robust multi-entity accounting functionality. Creating new entities as you expand into new locations or business ventures is easy. Monthly consolidations, inter-entity financial transactions, and eliminations are simple, saving users days of valuable time each month.

3. Dynamic Allocations

Allocate assets, costs, and revenue contributions across products, projects, departments, and other critical business dimensions with dynamic allocations. Sage Intacct Dynamic Allocations eliminates the need for spreadsheets, saving time, increasing accuracy, and streamlining audits.

4. Advanced Dashboards and Reporting

Sage Intacct makes it simple to turn data into meaningful business insights, with advanced reporting and dashboards, including custom report writing and interactive visual explorer tools.

5. Multi-Currency Accounting

By automating multi-currency accounting transactions, Sage Intacct eliminates error-prone manual input. With its centralized internal controls, your data is more timely, accurate, and reliable — which means you’ll close the books faster.

What Are the Key Business Advantages of Sage Intacct?

There are numerous business advantages for businesses making the transition. Here are five of our clients’ favorites:

Real-Time Financial Insights

Sage Intacct’s real-time reporting capabilities allow businesses to make informed decisions faster. For example, a distribution company can instantly track sales data across multiple locations, enabling quick response to market trends and inventory management.

Scalability for Growth

As businesses expand, Sage Intacct software scales to meet their evolving needs. A tech startup, for instance, can seamlessly integrate new revenue streams or business units without overhauling its financial system.

Improved Efficiency and Productivity

Automation features in Sage Intacct reduce manual tasks, increasing overall productivity. For example, a professional services firm can automate its invoicing process, significantly cutting down the time spent on manual data entry and reducing errors.

Enhanced Compliance and Security

With robust security and compliance tools, Sage Intacct helps businesses easily meet regulatory requirements. Healthcare providers, for example, can maintain compliance with financial regulations while safeguarding sensitive financial data.

Quarterly, Automatic Upgrades

Sage Intacct provides quarterly upgrades that include new features and product enhancements in each release. Updates are deployed automatically through the cloud, without any downloads or installation required on your end. So you’ll avoid disruptions of an upgrade and reliance on IT resources.

Integration and Customization

Sage Intacct’s ability to integrate with other business systems and its customizable features make it an adaptable solution for diverse business needs. An e-commerce business could integrate the systems with CRM and e-commerce platforms, ensuring streamlined operations and better customer data management.

What Modules Are Available?

Core Financials

With Sage Intacct’s core modules, businesses can efficiently manage business strategy and accounting processes, including resource-intensive financial processes like accounts payable, accelerating finance team productivity. Core financials are made up of:

- Intelligent General Ledger

- Cash Management

- Accounts Receivable

- Order Entry

- Accounts Payable

- Purchasing

- Reporting and Dashboards

Advanced Accounting Modules

Sage Intacct offers advanced modules that automate and streamline key finance and accounting processes. Functionality includes multi-entity and global consolidation, revenue recognition, inventory control, project accounting, fixed assets, vendor payment services, and more.

Extended Capabilities

Sage Intacct’s capabilities extend even further with the Sage Intacct Marketplace, providing integrations for every business function. Plus Sage Intacct offers a public API, which means that if you are using a system without an existing integration on the Marketplace, your partner can create a tailor-made integration just for you. This allows for seamless connectivity and ensures that the system meets your specific requirements.

What’s the Difference Between Sage 100 and Sage Intacct?

Sage 100 and Sage Intacct are both ERP (Enterprise Resource Planning) and accounting systems designed for small- and mid-sized organizations. However Sage Intacct is a native cloud solution where Sage 100 is on-premise. Aside from the benefits of the cloud we’ve explored here, Sage Intacct is an ideal next steps for Sage 100 users that have and require ERP features that will scale up with them. Here are some signs that it may be time to make the switch.

- Have multiple entities and/or multiple locations; and manages a complex organizational structure requiring consolidations, eliminations, inter-entity transactions, and allocations

- Are experiencing or anticipating growth in the next 1-2 years

- Relies on spreadsheets for financial reporting and analytics and spends too much time on data entry and other manual processes

- Uses one or more cloud applications that you need/want to integrate into your core financial modules

- Has employees that need remote access

What Types of Industries Use Sage Intacct?

Sage Intacct is a comprehensive cloud-based financial management and accounting software ideal for small- and mid-sized businesses, particularly high growth. While Sage Intacct is suited to any industry, it’s particularly well-suited for several, each benefiting from its specific features and capabilities. Some of the key sectorsn include:

- Construction and Real Estate

- Nonprofit

- Financial Services / Family Offices

- Professional Services

- Hospitality / Franchise

- Software-as-a-service (SaaS) and Technology

How Much Does Sage Intacct Cost?

Sage Intacct offers subscription-based services priced per module and per user. Therefore, costs vary by client. The Software Pricing models provide flexibility in managing costs with active modules and number of users tailored to your current business needs. This helps keep your initial investment within reasonable limits and offers flexibility for expanding if required.

In general however, pricing can run from $20,000 a year for a smaller five-user company with basic requirements to $75,000 or more for a SaaS or professional services organization with complex requirements such as subscription billing, order management, contract management, and revenue recognition. Implementation fees typically start around $20,000 and vary based on the complexity.

How Long Does the Implementation Take?

Earlier implementation of on-premise accounting software for small- and mid-sized businesses could take four to six months. While the exact length of the implementation varies by deployment, Sage Intacct’s cloud service coupled with an established integration process delivered by a Sage Business Partner (or reseller) like MicroAccounting allows businesses to operate much sooner.

FAQ: Choosing MicroAccounting for Your Implementation

Migrating to Sage Intacct represents a strategic move towards advanced financial management. To optimize the benefits of moving to the cloud, it’s essential to choose a partner with deep expertise and a commitment to service — that’s where MicroAccounting comes in. We will help your businesses implement a powerful tool for navigating today’s complex financial landscape delivering enhanced insights, scalability, and efficiency. This strategic advantage positions your organization for success today and sustained growth and agility in the future.

How does MicroAccounting ensure a smooth transition?

A smooth implementation requires detailed planning and diligent project management — and we’ve set the bar high with our comprehensive and proven approach.

MicroAccounting provides expert guidance, full accounting capabilities, industry-specific customization, personalized (and personable!) service, and a strategic approach to leverage all benefits of Sage Intacct.

Our consulting specialists have extensive experience migrating data from a variety of applications into Sage Intacct. We’ll work with you to design and implement the most cost-effective and comprehensive data migration path to allow you to preserve and leverage vital legacy data.

What if I need specific customized features from QuickBooks or Sage 100 in Sage Intacct?

MicroAccounting works closely with you to identify essential features in your existing ERP system and how they can be accommodated after you migrate to the new system. In many cases, out-of-the-box advanced functionality already in Sage Intacct renders many customizations obsolete. Sage Intacct integrates with hundreds of third-party applications in the Sage marketplace, ensuring specific and best-in-class functionality.

Will I receive ongoing support from MicroAccounting post-migration?

Ongoing support is a hallmark of MicroAccounting’s service. We provide ongoing technical assistance, regular informational webinars, a monthly product newsletter, and other initiatives to help ensure your organization enjoys a maximum return on its technology investment.

How does MicroAccounting address training for different levels of users?

MicroAccounting offers tailored training programs catering to various user levels to ensure everyone is proficient with Sage Intacct.

Request a Call Back to Discuss Sage Intacct

Whether you’re a current MicroAccounting client or new, you can contact our consulting team for a business needs assessment and a personalized demonstration of Sage Intacct accounting software. in the meantime check out these resources