What is Dimensional Accounting and How Can It Help You?

If you want to use your natural general ledger (GL) accounts, departments and any other segments on which you need to report, ERP systems traditionally require you to create a fully qualified GL account. This means taking the time to set up several hundred accounts, not to mention the unwieldy process of managing all of them and dealing with a bloated chart of accounts.

For example, a company that needs to report on 50 natural GL accounts at a departmental level, and 5 departments needs to set up 50×5, or 250 fully qualified accounts in the account structure. Also, take into consideration that this may require a location or any number of other reportable segments.

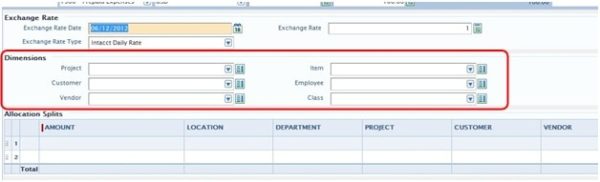

A much more simplified method is dimensional accounting. This method involves categorizing, labeling, or tagging transactions using pre-defined values known as accounting dimensions. These dimensions provide insights into business performance, aiding decision-making and solutions for improvement. By organizing financial data into these dimensions, dimensional accounting can lead to a more detailed view of business performance and help in making informed decisions to improve financial outcomes. Here, we explain how it works. See also, sample screen grab below, which shows the dimensions, encircled in red.

What are accounting dimensions?

It’s easiest to think of accounting dimensions as replacing subaccounts in your general ledger. Rather than having segments for “location,” “project,” and “department,” for example, you use dimensions to represent these values. What you may not have realized is that you can establish relationships between dimensions to speed and simplify data entry tasks while also improving accuracy.

With dimensional accounting, you would set up each segment of the items on which you will report in a separate field. You can then tag each accounting transaction with the appropriate dimension values. This allows you to maintain each segment separately, thereby limiting the overall maintenance on GL accounts and your chart of accounts remains pure.

Relationships can be defined as both one-to-many and many-to-one. For example, your projects are unique to one location, so you’d establish a one-location-to-many-projects relationship. On the other hand, you might have a select list of departments associated with each project, so you’d establish a many-departments-to-one-project relationship. Additionally, you can also define one-to-one relationships and many-to-many relationships to accommodate your organizational structure. Each business unit can be designated as its own independent dimension for efficient tracking and reporting.

Dimensions are available with Sage Intacct, which allows you to tag accounting transactions throughout the product to ensure you don’t miss a single detail in your financial reporting. You can also identify by GL account when a segment value is required, so your users entering data can’t inadvertently miss tagging a transaction.

Sage Intacct also takes this one step further by making sure the dimensions are available in their built-in reporting tool. This means the days of needing complex skills in order to write a departmental transaction report are over.

Sage Intacct also takes this one step further by making sure the dimensions are available in their built-in reporting tool. This means the days of needing complex skills in order to write a departmental transaction report are over.

How can dimensional accounting help you with financial reporting

Think of the time it takes you to add GL accounts to your system when you simply add a new department or location. Dimensional accounting makes this a single set-up as a dimension value, making it now available throughout the system and in your financial statements. It also aids in financial planning by allowing for better tracking and categorization of transactions. While keeping your chart of accounts streamlined. You know how much time it usually takes to create new reports when a department or location is added so you can report on that new value.

Dimensional accounting is not only easy to use but it’s a significant time saver at every step of the process—set-up, data entry and reporting. It helps optimize your financial reports by providing a more detailed view of how each entity is performing individually and collectively.

Other dimensional relationship ideas

You can establish relationships between both standard and user-defined dimensions, opening the doors of possibility wide. Dimensions can be used to better understand the balance sheet and track revenue.

-

Assign a single salesperson to a customer

-

Assign a list of employees to a location

-

Assign employees to multiple projects

-

Assign employees to a location

-

Limit certain general ledger account numbers to a location or cost center to track revenue and expenses at each location

Sage Intacct dimensions are an incredibly powerful, yet remarkably straightforward, tool that streamlines and simplifies data entry tasks while ultimately providing for greater reporting insights.

Dimensional accounting simplifies something that has traditionally been a system administrator’s challenge, making it so easy it can be done in minutes. It combines flexibility and functionality to grow your business without adding a burden on the back end. Dimensional accounting can also help in tracking financial activity through documents like the profit and loss statement.

Contact us to learn more about dimensional accounting and how it can help make your reporting process more efficient for more informed decisions. And check out this video to see how Sage Intacct’s cloud based accounting system can handle dimensional accounting natively.