Sage Intacct Cash Management Keeps the Cash Flowing

Managing your organization’s cash effectively is essential for survival and growth. Whether you’re looking to streamline operations, maximize your financial visibility, or improve control over your finances, Sage Intacct Cash Management is a powerful tool to help your business excel.

Why Cash Management Matters

Cash management goes beyond just knowing what’s in your bank account. Instead, it’s about strategically overseeing your cash inflows and outflows, ensuring you have the resources to cover your financial obligations and capitalize on opportunities. Effective cash management affects nearly every aspect of your business, from payroll and purchasing to investments and planning.

Managing cash effectively involves many moving parts and takes a lot of time. Without an advanced tool like Sage Intacct Cash Management, managing your company’s cash position is a far more hands-on and time-consuming process. For example, your finance team would likely rely heavily on manual data entry, spreadsheet-based tracking, and physical bank statements to monitor and reconcile accounts. Additionally, you might spend considerable time communicating with department heads and banking institutions to confirm transaction details and resolve discrepancies.

Sage Intacct Cash Management (part of the Sage Intacct core financial suite) can eliminate many of those manual steps. Here’s how it works.

The Sage Intacct Cash Management Advantage

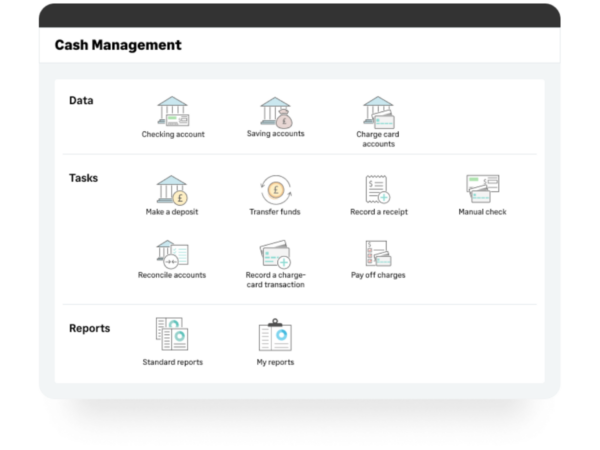

Sage Intacct Cash Management is a tool designed to help your business manage its cash flow and banking transactions efficiently. Below are some of its key features and benefits:

Direct Cash with Real-Time Precision

Sage Intacct Cash Management offers unparalleled visibility into your cash positions across all accounts and locations. With real-time updates and comprehensive dashboards, you’re always informed and in control, ensuring you can direct cash precisely where it needs to go.

Effortless Reconciliations

Sage Intacct automates and simplifies reconciliation by connecting directly with your bank and matching transactions efficiently and accurately. This saves time and means that your financial statements are always up-to-date and accurate.

Centralize Financial Operations

Manage all your bank accounts from a single platform. Sage Intacct gives you a holistic view of all transactions and balances across every location and entity. Whether it’s checking accounts or credit lines, see everything in real-time, ensuring comprehensive control and immediate responsiveness to your company’s needs.

Automated Workflows for Efficiency

From bank reconciliations that connect directly to thousands of financial institutions globally to automated transaction imports, Sage Intacct makes cash management fast and error-free. The automation extends to reconciling your checking, savings, and credit card accounts swiftly, helping you spot exceptions, manage errors, and prevent fraud — all from one central location.

Accelerated Financial Close

Reducing manual data entry and boosting data accuracy speeds up monthly closing so you can spend time on value-adding tasks.

Multi-Currency Functionality

If your business reaches across borders, you’ll appreciate Sage Intacct’s multi-currency capabilities. You can easily manage international transactions, adjust for currency fluctuations, and maintain compliance with global financial reporting standards.

Integrated Financial Management

The Cash Management tool doesn’t operate in a silo. It integrates seamlessly with other critical financial functions in Sage Intacct, like accounts payable and receivables, ensuring consistency and eliminating discrepancies across your financial system.

Show Me The Money

In a world where effectively managing cash is more critical than ever, Sage Intacct provides the clarity, control, and efficiency your business needs to thrive. Curious about this valuable tool? Contact us to learn how we can help you harness the full power of Sage Intacct Cash Management.