Sage AR Automation: Get Paid Faster and Easier

We often discuss the transformative power of automation and how it streamlines operations across various business functions. Here, we explore another area where automation can significantly impact accounts receivable (AR). Sage AR Automation is available to Sage 100 users to help automate AR processes, reduce Days Sales Outstanding (DSO), and enhance cash flow management. Here’s an introduction to Sage AR Automation and the value it delivers.

Why Companies Need AR Automation

Effective accounts receivable management remains one of the more complex and labor-intensive aspects of a business’s operations. As your transaction volumes increase and billing complexities grow, the limitations of manual AR processes become apparent, often leading to constricted cash flow, increased administrative burdens, and greater susceptibility to errors. Sage AR Automation addresses these challenges head-on.

Streamline Operations

Sage AR Automation switches the receivable process from reactive to proactive. By automating routine tasks such as invoice generation, payment reminders, and reconciliation, you can significantly reduce administrative overhead, freeing up valuable resources to focus on strategic financial planning and customer service.

Enhance Data Accuracy

Manual data handling is error-prone, which can cascade into larger issues like incorrect billing and delayed revenue recognition. Sage AR Automation mitigates these risks by automating data entry and processing, ensuring that your financial statements are accurate and reflective of your company’s true financial status.

Consistent Cash Flow

Slow and inconsistent cash flow can make it challenging to meet operational expenses and plan for growth. Sage AR Automation keeps cash flow steady and predictable by accelerating the invoice-to-payment cycle through automated processes and collections management.

Improved Customer Interactions

Automated systems provide your customers with timely invoices and more transparent communication, and the solution’s self-service portals allow for easy account management.

What is Sage AR Automation?

Sage AR Automation was born when Sage acquired Lockstep in 2022 and quickly integrated into the Sage 100 ecosystem. Sage AR Automation automates critical financial tasks such as invoice generation, payment collection, and customer communications. It transforms traditional, manual AR tasks into a streamlined, efficient, and error-reduced process so your business can focus more on strategic growth and less on day-to-day financial administration.

Key Capabilities of Sage AR Automation

Sage AR Automation extends the native functionalities of Sage 100 with several key features:

Automated Invoice Delivery and Reminders

Ensures that invoices are promptly sent and followed up on, reducing the effort to manually manage these tasks.

Customer Self-Service Portal

Customers can access their account information, review invoices, and make payments through a user-friendly portal, which reduces administrative overhead and speeds up the payment process.

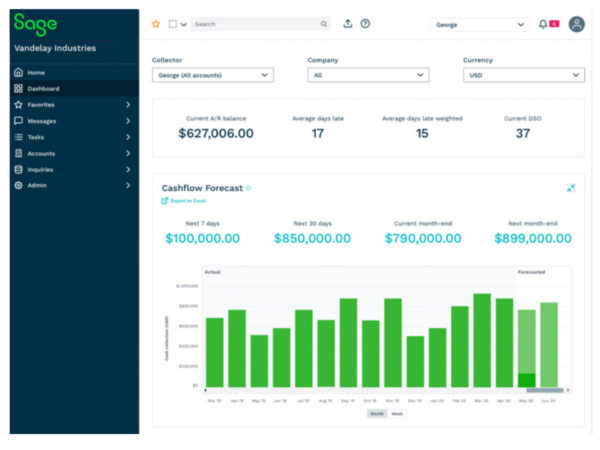

Real-Time Analytics and Reporting

Provides comprehensive insights into AR performance, helping you track metrics like DSO and identify trends that could affect your cash flow.

Integrated Payment Processing

Facilitates faster payment through multiple channels, ensuring you receive funds quickly and securely.

Benefits of Sage AR Automation

Sage AR Automation brings benefits that can significantly impact a company’s financial and operational efficiency. Here’s a closer look at some of these key advantages:

Increased Working Capital

One of Sage AR Automation’s primary benefits is the acceleration of cash inflows. By reducing Days Sales Outstanding (DSO), your company can see an increase in your bank balances faster. This improvement in working capital is crucial for maintaining liquidity and ensuring adequate funds are available for growth and operational needs.

Increased Cash from Operations

With more working capital available sooner, you can generate additional cash from operations. This boost allows your business to reduce or avoid interest expenses associated with borrowing while potentially increasing interest earnings by having more funds available for investment.

Freed Staff Time

Automating repetitive tasks such as sending out reminders, processing end-of-month statements, and applying cash to outstanding invoices frees up the accounting team’s time. The time saved allows them to focus on more complex and impactful work, such as collections, resolving disputes, and addressing other issues that may delay payments.

Increased Shareholder Value

Automating AR processes helps cut operational costs, such as eliminating the need for paper and reducing labor-intensive tasks. These savings translate directly to your bottom line, enhancing profitability and increasing shareholder value.

Average 20X ROI

The combination of increased working capital and cost savings from operational efficiencies typically delivers an impressive return on investment, averaging 20 times the cost of implementing the Sage AR Automation solution.

Sage AR Automation Bolsters Your Bottom Line

In conclusion, with improved cash flow, enhanced operational efficiencies, and significant cost savings, Sage AR Automation is an essential asset for any business aiming to optimize its accounts receivable processes and bolster its bottom line. Contact us to learn more (or see a demo!).