What Are Bank Feeds?

Bank feeds are a way to connect your accounting application to your financial institution so that you can download transactions and more quickly match them as part of the reconciliation process. A software innovation, bank feeds are a powerful tool that can be integrated into accounting software, automating manual reconciliation and making businesses more efficient. This blog post explores the benefits of bank feeds and how they can help transform accounting processes.

Advantages of Bank Feeds in Accounting

Bank feeds offer several advantages in managing accounting processes. Firstly, automation of manual tasks enables finance professionals to perform accounting tasks faster and more efficiently. Secondly, real-time integration provides timely and future-oriented reporting and analysis. Thirdly, security of financial accounts is improved, as bank feeds eliminate the need for manual entry, reducing the risk of errors and fraud.

A more agile and responsive finance team

Bank feeds have revolutionized the way finance professionals manage accounting tasks. Instead of sifting through endless amounts of paperwork and manually inputting data from bank accounts, online bank feeds automate much of the process. This increased efficiency allows teams to be more agile and responsive to the ever-changing needs of their business. With bank feeds, these professionals can focus on making important decisions rather than bogged down by tedious administrative tasks. It’s no wonder that the use of bank feeds has become widespread in the finance industry.

Bank feeds simplify bank reconciliation

If you’re a business leader, you know that bank reconciliation can sometimes feel like a daunting task. Luckily, technology has provided a solution. By allowing your accounting software to pull bank transactions directly from your bank accounts, bank feeds eliminate the need for manual data entry. This not only allows your team to save time, but it also ensures accuracy in your reconciliation. With bank feeds, you can trust that your financial records are up-to-date and reliable, giving you peace of mind into your expenses as you focus on running your business.

How Bank Feeds Transform Accounting Processes

By integrating data into core processes, bank feeds help finance professionals to make better business decisions. Data integration makes immediately actionable insights available to support decision-making and strategic planning. Bank feeds also reduce manual bank transaction entry and review and greatly streamline reconciliation. This increased efficiency gives businesses greater agility in responding to changes and challenges in the market.

Integration into core processes

The integration of data into core processes has revolutionized the way businesses operate, and bank feeds are no exception. By leveraging the power of technology, a bank’s own feeds can now provide timely, dynamic, and future-oriented reporting and analysis to support business decisions. This means that banks can now provide their clients with real-time insights, allowing them to make better-informed decisions that positively impact their bottom line. With bank feeds, businesses can stay ahead of the curve by forecasting future trends and analyzing past performance, giving them the edge they need to succeed in today’s fast-paced, data-driven business world.

Secure data for peace of mind

As more and more businesses move their financial operations online, it’s essential to prioritize security. Fortunately, bank feeds have you covered. These invaluable tools offer top-of-the-line security to protect your sensitive financial data. They also ensure that data is accurate and up-to-date by connecting directly to banks and payment service providers. With such reliable connections and industry-leading security measures, you can have confidence in your financial management systems and focus on running your business with peace of mind.

Sage Intacct Makes it Easy

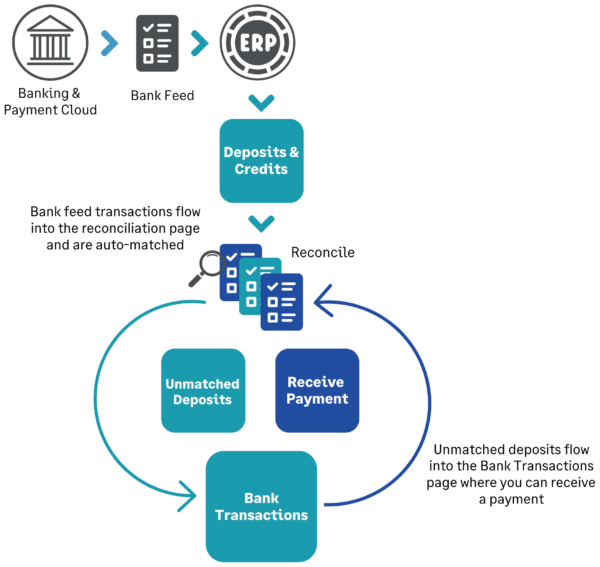

Sage Intacct supports bank feeds, allowing you to directly connect to thousands of U.S. banks, bring in transaction data and perform “soft” reconciliations as often as you wish—even daily. The result is a much more accurate picture of your organization’s financial standing along with much less work at month end.

After a quick configuration process, you’ll be set to bring your transactions into reconciliation where they are auto-matched, saving you valuable time and making your month-end reconciliation process faster and easier. You choose which field(s) to match on, including: date, document number and amount. Any unmatched transactions flow into the Bank Transactions page where you can receive a payment against a customer’s invoice. Refresh the feed at any time so you’re always working with the most current transactions.

Conclusion

Bank feeds have significantly cut down on data entry for businesses, greatly boosting efficiency. Moreover, when integrated with reporting and decision-making tools, they can elevate online accounting software from just record-keeping to a dynamic business analysis platform.

Contact us with any questions you have about bank feeds or Sage Intacct.