Automating Sales Tax Exemption Certificate Management

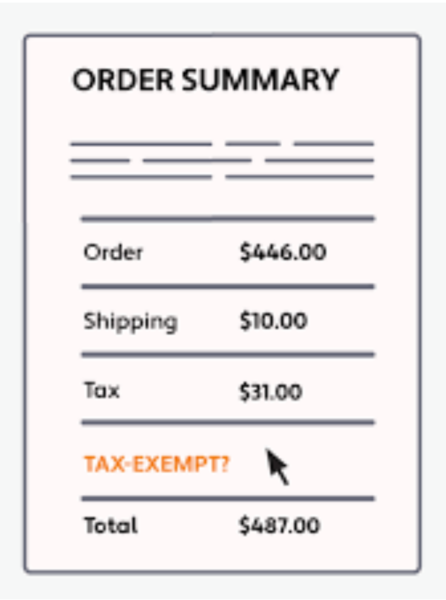

Exemption certificates are documents that a buyer provides to a seller to provfe that a sales transaction is exempt from sales tax. Sounds simple enough, right? The trouble is that exemption certificate management can be complex due to the range of exemptions available and the need to renew or regularly check if an exemption certificate is valid. To make things worse, auditors are more likely to fine you than they are to fine the buyer if you mishandle sales tax exemption certificates. As the number and types of products or services you sell grows, so does the likelihood you’ll have more tax-exempt sales and more complexity in maintaining compliance.

Avalara Exemption Certificate Management (ECM) is Here to Help

There’s more to tax exemption certificate management than meets the eye — and no business is exempt from the tax law rules. That’s why Avalara ECM software should be an essential part of your compliance strategy. Here’s a look at the common challenges businesses face surrounding sales tax exemptions, some simple compliance steps to follow, and how Avalara ECM can help.

There Are Few Exemptions Surrounding Exemption Management

The management of sales tax exemption certificates is crucial for businesses to avoid sales tax audit risk. The impetus is on you. Without a proper system in place, your company can be liable for unpaid sales taxes on transactions where you incorrectly accepted tax exemption certificates or failed to collect a valid certificate.

Mismanaging tax exemption certificates can lead to financial penalties, interest on unpaid taxes, and even reputational damage to your business. While specific instances of named companies getting into trouble solely because of exemption certificates might not make the news — like larger tax evasion cases or corporate scandals do — it’s very common for businesses to face fines or penalties during sales tax audits as a result of mismanagement of exemption certificates.

Ramifications of Non-Compliance

Below are some very real consequences that businesses can face:

- Financial Penalties

If you can’t produce a valid sales tax exemption certificate during an audit, your state may assess taxes owed, plus penalties and interest. The fines can be substantial, especially if the oversight has been going on for a long time. - Reputational Damage

News of tax mismanagement can hurt your company’s reputation, especially locally or within your industry. Clients and partners may question your company’s competence or integrity. - Operational Disruptions

Responding to audits or addressing tax discrepancies can zap significant resources, both in terms of time and money. It can lead to operational disruptions, especially for small and medium-sized businesses. - Loss of Business

In some cases, you may lose out on contracts or opportunities due to a lack of proper tax compliance — or the reputational damage that comes from bad press.

It’s worth noting that even minor missteps can get amplified on social media or in your local news, leading to a more significant impact than your business might expect. Maintaining strict compliance, including proper management of exemption certificates, is the best preventive measure.

Steps To Help Ensure Compliance

We encourage our clients to take the following steps to help meet their compliance obligations and reduce risk:

- Establish a process and procedure to collect, review, validate, and store exemption certificates. For example, request new certificates from customers as part of the onboarding process.

- Validate all certificates by reviewing for completeness, accuracy, and timeliness.

- Monitor expiration dates and update expiring certificates regularly.

- Leverage technology (like Avalara ECM) to automate requests, store certificates, manage certificates, and better respond to audit requests.

Avalara published a comprehensive state-by-state guide to exemption certificates that you may find helpful.

How Avalara Exemption Certificate Management Helps

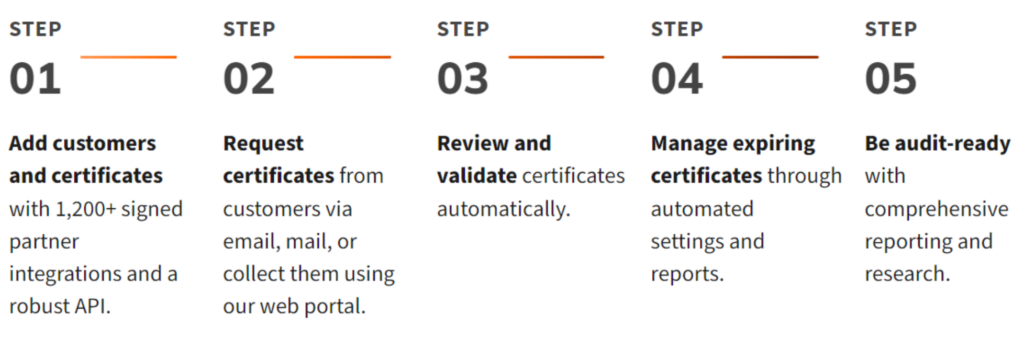

Avalara ECM streamlines and simplifies the tedious process of collecting, storing, accessing, and managing your customers’ exemption certificates. Among its capabilities:

- Monitoring Compliance

Stay ahead of evolving requirements related to remote work, drop shipping, inventory storage, and sales tax exemptions. - Storage

Avalara’s solution provides a secure, central repository for your business to store, organize, exemption certificates while providing easy access. It simplifies the process of keeping track of many certificates, especially for companies with many tax-exempt customers. - Validation

The software helps validate the certificates to ensure that they are correct and up to date — and tracking expiration dates to alert you to expiring certificates. - Automation

Avalara ECM can automate the process of collecting, validating, and storing certificates, which can help reduce the manual workload for staff. - Integration

Avalara integrates with many popular ERP and eCommerce systems—Sage 100, included, of course. - Renewals and Expirations

Avalara can send notifications when certificates are nearing expiration, helping your business remain compliant. - Reporting

Avalara offers robust reporting capabilities to allow you to review the status of your sales exemption certificates and ensure continuing compliance. - Streamlined Team Access

Grant read-only access to departments, sales teams, partners, and auditors for simplified collaboration.

5 steps to exemption certificate compliance with Avalara

Exemption Certificate Management Made Easy

Tax exemption certificate management is essential to doing business and avoiding audit risk — but it’s nobody’s idea of fun. Avalara ECM simplifies and automates the process, helping ensure compliance with tax laws while minimizing the time and effort involved. Plus, it integrates fully with Sage 100. Contact us to learn more, watch the on-demand webinar: How to Automate Exemption Certificate Management, or visit our Avalara solutions page.